Get the latest business insights from Dun Bradstreet. Study methodology and approach.

Copenhagen Infrastructure Partners Stock Price Funding Valuation Revenue Financial Statements

Their most recent investment was on Mar 24 2022 when Sunfire raised 86M.

. Copenhagen Infrastructure Partners has made 2 investments. Become a member for free. The team has a broad.

On November 5 2021 KeyBanc Capital Markets KBCM successfully advised Copenhagen Infrastructure Partners PS CIP on its divestiture of the 122 MW Operating NC Solar Portfolio to TransAlta Corporation. How Vaisala partnered with DNV to conduct the IEC 61400-50-3 classification. NSE Gainer-Large Cap.

Copenhagen Infrastructure Partners has acquired Offshore MW on Aug 25 2016. They have a disperse portfolio ranging from renewables and energy infrastructure in solely OECD countries to Asian and Latin American markets. Company profile page for Copenhagen Infrastructure Partners PS including stock price company news press releases executives board members and contact information.

Ambitious people working in renewable energy. AUM 350 000 M. Jan 15 2022 - Analyst in Copenhagen Capital Region.

CIP is a first mover in the US. Ad Looking to Take Advantage of Increased Infrastructure Spending. May 12 2022.

Langelinie Allé 43 2100 Copenhagen Ø Denmark Investor type VC. Field validation with GE Power and Water. Travers Solar is expected to be one of the worlds largest solar projects once completed in 2022CALGARY Alberta June 23 2021 GLOBE NEWSWIRE -- Copenhagen Infrastructure Partners CIP and.

CIP was established in 2012 by senior executives from the Danish energy industry in a joint initiative with founding investor PensionDanmark the largest labor market pension company in Denmark and. We focus on long-term investments in energy infrastructure with attractive risk-adjusted returns stable cash flows and low correlation to the business cycles making our investment product tailor-made for institutional investors. Although working in renewable energy the culture feels more like investment banking highly male dominated and not closely connected to doing something for climate change.

Find useful insights on Copenhagen Infrastructure Partnerss company details tech stack news alerts competitors and more. CIP is a first mover in the US. Company profile page for Copenhagen Infrastructure Partners KS including stock price company news press releases executives board members and contact information.

Infra fund loans 61m to Texan wind. Copenhagen Infrastructure Partners CIP is set to make an 81 million equity investment in an onshore EquityRenewables. Danish fund manager Copenhagen Infrastructure Partners CIP has launched a new energy infrastructure Investment.

Offshore wind industry entering the market in 2016. Offshore wind industry entering the market in 2016. Copenhagen based fund management company with solar wind and biomass assets Copenhagen Infrastructure Partners CIP are a large-scale fund manager currently operating eight funds worth over 16bn.

Use Slintel to connect with top decision-makers at Copenhagen Infrastructure Partners. Copenhagen Infrastructure Partners CIP the worlds largest dedicated fund manager within greenfield renewable energy investments and a leader in offshore wind globally announces on the first day of COP26 an ambition and a roadmap for increasing and accelerating its role in delivering on the energy transition by deploying EUR 100bn into green energy. Copenhagen Infrastructure Partners is a multinational team with extensive experience and knowledge within the fields of regulated infrastructure and renewable energy.

20 2020 PRNewswire -- Renewable energy developer Tri Global Energy announced today that project owner and partner Denmark-based Copenhagen Infrastructure Partners CIP has achieved commercial operation of Glasscock Countys 162-megawatt MW Bearkat II the second phase of the Bearkat wind energy project. Copenhagen Infrastructure Partners is a multinational team with extensive experience and knowledge within the fields of regulated infrastructure and renewable energy. CI I CI II CI III CI IV CI New Market Fund I NMF I CI Energy Transition Fund I ETF I CI Artemis I and CI Artemis II CI Advanced Bioenergy Fund I ABF I and CI Green Credit Fund I GCF I.

432p Fed says banks could withstand 10 unemployment 55 stock price drop in annual stress test. CIP manages ten funds and has to date raised approximately EUR 18bn for investments in energy and associated infrastructure. Pension funds back Scandinavian infrastructure fund with DKK88bn.

Best for Energy Infrastructure - Copenhagen Infrastructure Ii KS. Already included in developer and manufacturer Turbine Supply Agreements WindCube Nacelle continues to increase adoption and project success around the globe. Connor Clark Lunn Infrastructure.

Infrastructure Companies with Direxions 2X Leveraged Bull ETF. Private company information about Copenhagen Infrastructure Partners from MarketWatch. BACKGROUND OF THE PARTNERS.

The team has a broad range of competencies within corporate finance merger acquisitions engineering project development and project management. CIP will through its Copenhagen Infrastructure II KS and Copenhagen Infrastructure III KS continue leading the offshore wind industry by co-leading the construction of the first commercial scale offshore wind project in the US Vineyard Wind 1 of 800 MW. Copenhagen Infrastructure Partners PS CIP is an investment firm specializing in infrastructure investments particularly wind power.

Find company research competitor information contact details financial data for Copenhagen Infrastructure Partners PS of København Ø Hovedstaden. CIP will through its Copenhagen Infrastructure II KS and Copenhagen Infrastructure III KS continue leading the offshore wind industry by co-leading the construction of the first commercial scale offshore wind project in the US Vineyard Wind 1 of 800 MW.

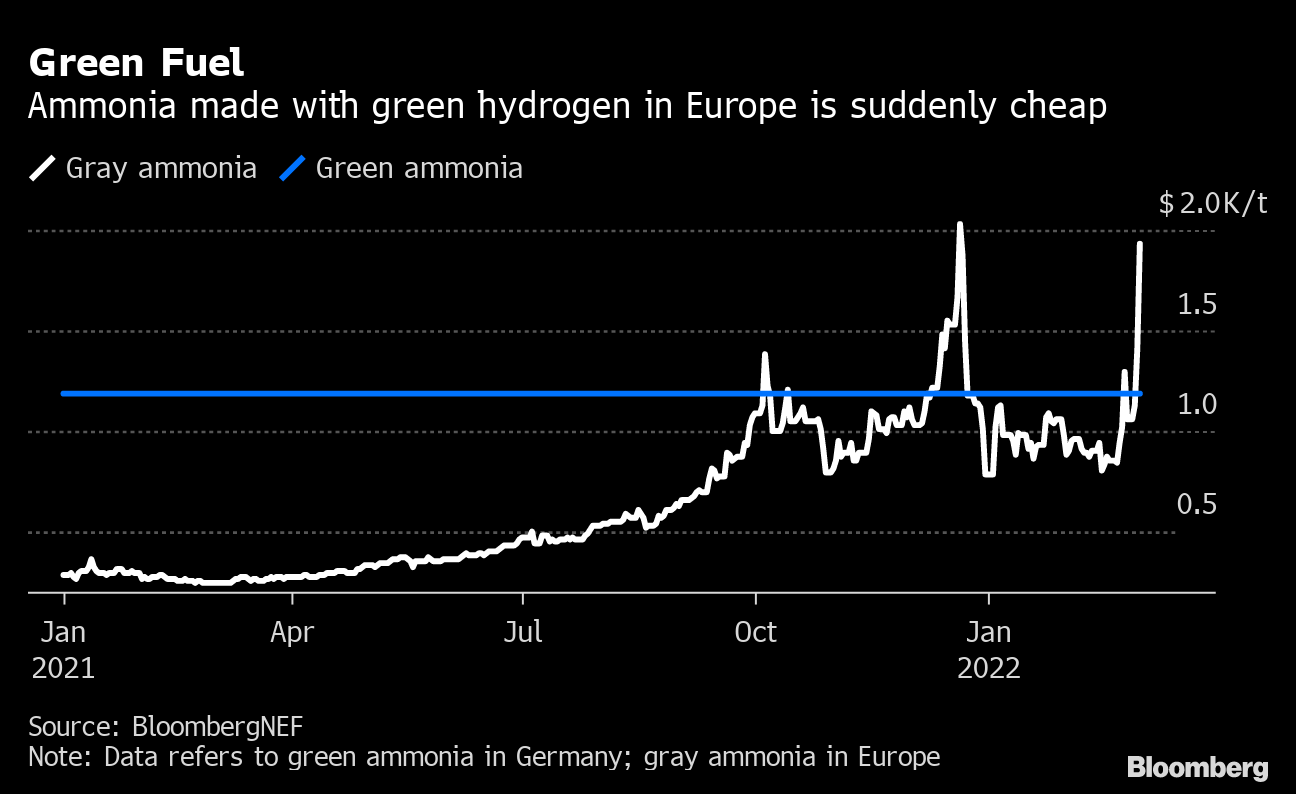

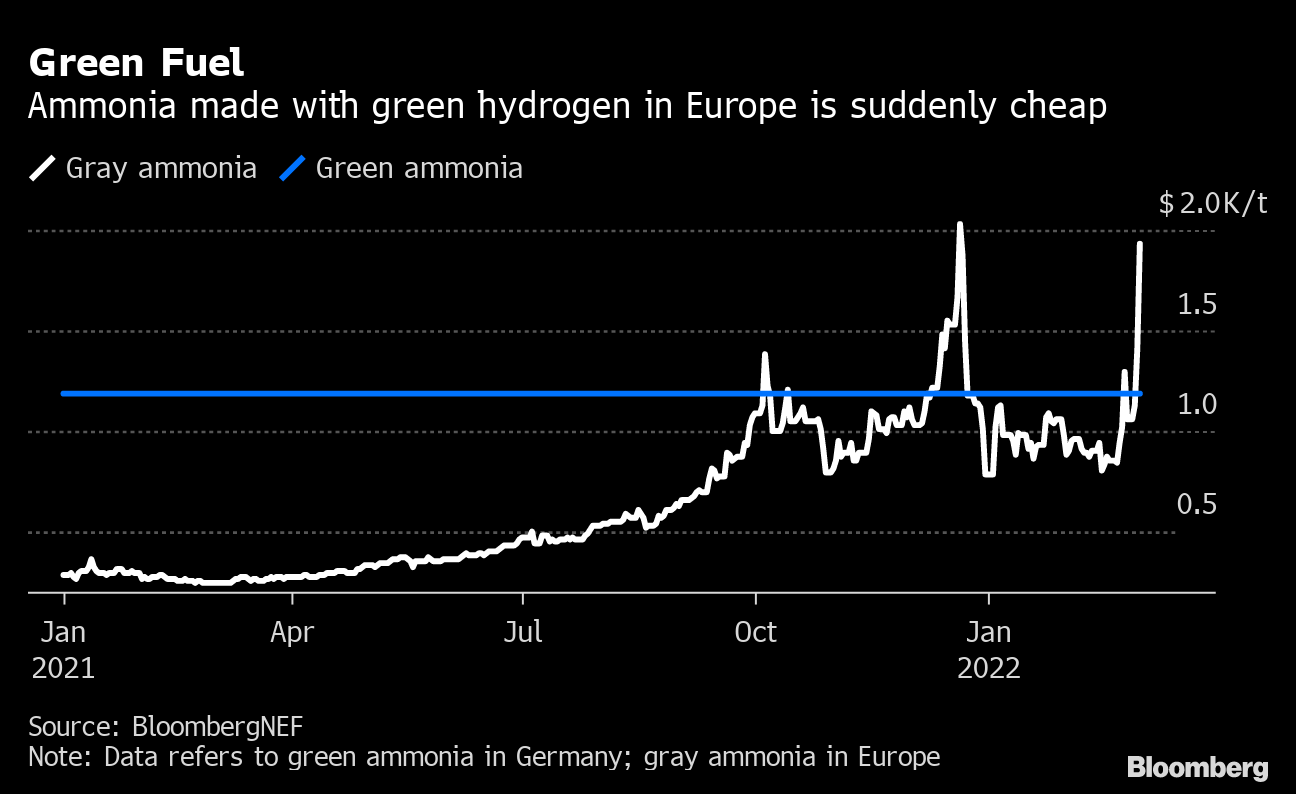

Russia S Invasion Supercharges Push To Make A New Green Fuel

Vineyard Wind Full Scale Us Offshore At Last Proximo

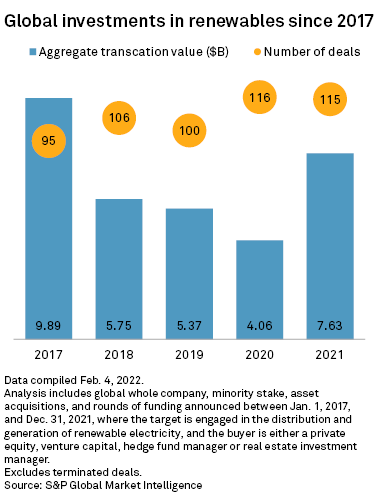

Private Markets Shrug Off Clean Energy Stock Sell Off S P Global Market Intelligence

Asx Renewable Energy Stocks Danish Firm Unveils Plans For Hydrogen Ammonia Facility In Wa S Murchison Region Stockhead

Press Releases Global Power Synergy Public Company Limited Gpsc

Private Markets Shrug Off Clean Energy Stock Sell Off S P Global Market Intelligence

Copenhagen Infrastructure Partners Linkedin

Cip To Start Nz Offshore Wind Campaign Renews Renewable Energy News

0 comments

Post a Comment